Off- highway vehicles (OHV) is a term used to define vehicles that can be driven on uneven or steep grounds. Generally, this refers to vehicles used in fields like agriculture, mining operations, or construction work.

When discussing electrification of automotive industry, most of us think of lightweight vehicle cars that people use every day. And while decarbonization of passenger cars is well underway, the sector of OHV is still somewhat lagging behind. However, the importance of electrifying this area cannot be understated as it is one of the major contributors to global pollution in a lot of countries. Taking Europe as example, OHVs make up more than 15% of nitrogen oxide (NOx) and around 25% of fine particulate matter (PM) emissions from all mobile sources. In USA, these type of vehicles produce 25% of total NOx emissions and almost of 75% of PM.

It is no surprise then, that various government agencies across the world are imposing ever stricter emission requirements for OHVs. Regulations by Environmental Protection Agency in (EPA) USA, European commission (Stage V Emission Regulations) or China (Stage VI Emission standard) act as a push for OEMs to move from traditional diesel powered equipment to other alternative powertrain sources. On top of that, many local governments are starting to impose additional requirements to reduce noise levels, especially in residential areas.

Trends in numbers

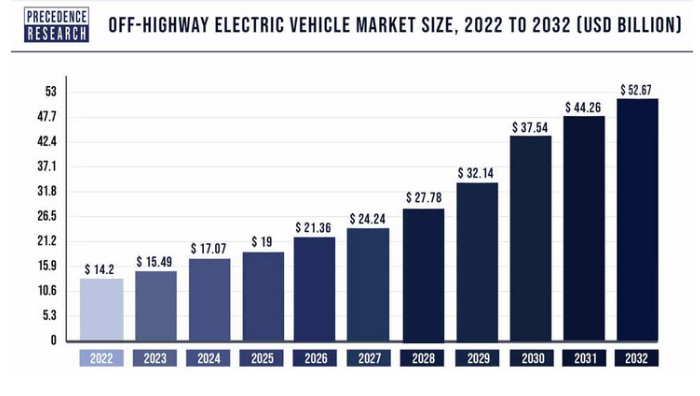

In 2022 the global electric OHV market was valued at 14.2 billion USD. However, in a span of 9 years ( by 2032) it expected to grow up to 52.57 billion USD, with a compound annual growth rate (CAGR) of 14.6%.

As it stands right now, North America has the biggest market share when it comes to global OHV market. This is due to a couple of factors, first being that the continent is home to some of the biggest names specialising in OHV (Deere & Company, CNH Industrial N.V., Caterpillar). Coupled with rigorous emission requirements introduced in the US in 2018 and the ever increasing demand in construction industry, it becomes clear why this area holds a dominant market share and is expected to have CAGR of 29.8% by 2032. The biggest growth is forecast for Asia Pacific region, with a projected CAGR value of 34.4% due to heavy investments in infrastructure by China and India, coupled with low production and labour costs. Europe is expected to grow at a CAGR of 25.5%, with the growth being tied mainly to increasing emission requirements, as well as the growing infrastructure.

Trends in electrification types

Electric vehicles can usually be split into 2 categories: hybrid electric vehicles (HEV), where a powertrain is a combination of battery and an internal combustion engine, and purely electrical vehicles, which can be fully powered either by batteries (BEV) or hydrogen.

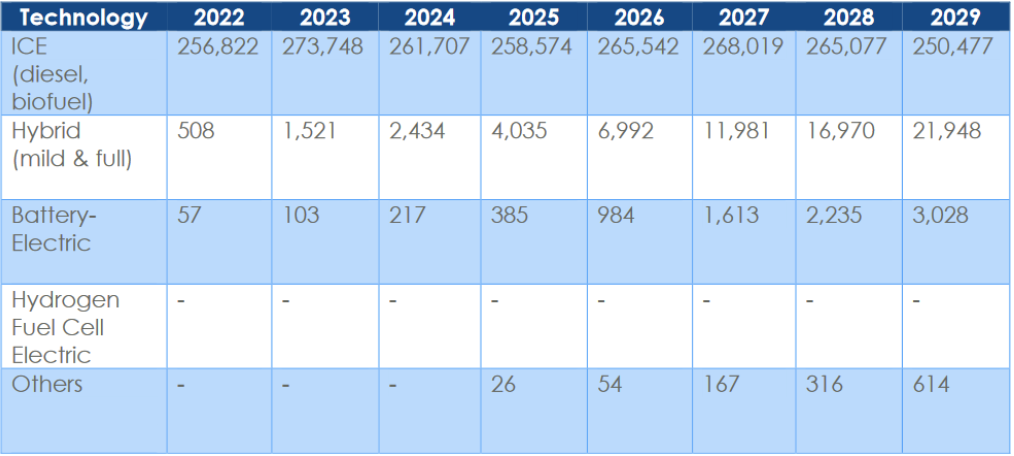

As it stands right now, HEV segment amounts to 66.2 % of the market share and is expected to retain its position over the upcoming years. The manufacturers of OHVs have adopted and been using HEVs ever since 2017, resulting in machines operating at higher efficiency and producing lower emissions. At the same time, the ongoing research and advancements in battery technology are leading to improvements in power output, energy density and battery longevity. As a result, manufacturers are looking to go fully electric even with more power demanding OHVs. Thus, in the light of these constant improvements in battery technology, and the ever tightening emissions regulations, it perhaps is no surprise that BEV segment is expected to grow at a CAGR of 29.5 % by 2032 and by that time, should make up a significantly larger part of electric OHVs.

Trends in different industries

Construction

Construction equipment is where the biggest progress of OHV electrification is made at the moment. Excavators of different sizes, wheeled or skid steer/track loaders are the type of vehicles that can be found in electric form more and more often. As an example, battery electric mini excavators accounted for 5% of the full US market in 2021, and that number is expected to grow up to around 15 % of the total market share by 2029. Naturally, part of the reason this field is seeing such progress in electrification is due to the relative ease with which charging infrastructure can be set up for most construction sites present in cities. Another and perhaps even more important factor is the lower and more compact size of a lot of these vehicles. Smaller size translates to lower power requirements and so, smaller batteries are able to power this type of equipment. And indeed, by now most of big construction equipment manufacturers have some BEVs in their lineup, with some of them shown in the table below.

| Manufacturer | Vehicle type | Model | Battery used | Capacity and voltage | Operation time | Charging options |

| JCB | Mini Excavator | 19C-1E | Li-ion | 19.8 kWh, 48 V | 5 hours | 110 V (10.5 hrs), 230 V (5 hrs), 415 V (2.5 hrs), all @ 16 A |

| Hitachi | Mini Excavator | ZX55U-6EB | Li-ion | 39.4 kWh, 400 V | 2 hours | 400V @ 32 A (1.25 hrs) |

| Volvo CE | Excavator | ECR25 | Li-ion | 20 kWh, 48 V | 4 hours | 230 V @ 16 A (5 hrs), 400V @ 32 A, (50 min) |

| Volvo CE | Wheel loader | L25 | Li-ion | 40 kWh, 48V | 8 hours | 400 V @ 16 A (6 hrs), 400V @ 32 A, (2 hrs) |

| Wacker Neuson | Wheel loader | WL20e | Li-ion | 14.1 kWh, 48 V | 5 hours | 230 V @ 16 A (4 hrs) |

| JCB | Telehandler | 525-60e | Li-ion | 24 kWh, 96 V | 8 hours | 240 V @ 16 A (5 hrs), 415V @ 32 A, (60 min) |

As it stands right now, battery powered electric vehicles dominate in the construction segment, while hydrogen powered machinery is still somewhat sparse. Nonetheless, a lot of the manufacturers are actively exploring hydrogen as a potential solution for their vehicles as well. Volvo, for example, is testing a hydrogen powered articulated truck. Chinese heavy equipment manufacturer Sany has launched production of fuel cell powered dump and mixer trucks in 2021, while Hyundai has unveiled a concept for a hydrogen wheeled excavator last year.

Interestingly, it is not just fuel cell technology which is being looked at. JCB, one of the biggest manufacturers of construction equipment, has shifted their focus from fuel cells to hydrogen internal combustion engines (ICE). Back in 2020 the company began testing their prototype excavator JCB 220X which at the time was powered with fuel cell technology. However, after extensive running in the quarries, JCB has arrived to a conclusion, that for now, fuel cells were too complicated and expensive. The company found that fuel cells were slow in transient response, sensitive to dust and vibration, required high capacity cooling and complex electronics to manage power supply between fuel cell and battery. From there, the company has decided to move on to hydrogen combustion solutions and from the ground up has built their own hydrogen engine which was then fitted to a backhoe loader and a telehandler in 2021. This year, JCB is supposed to start using hydrogen diggers on the roads and building sites in the UK, signifying the progress made with this technology.

Another interesting thing to note is the way JCB approached the problem of hydrogen refuelling. As it stands right now, one of the biggest challenges with hydrogen powered vehicles (fuel cell or hydrogen) is the lack of infrastructure. For remote locations like quarries and mining sites this problem is even more pronounced. As a result, JCB has developed a mobile hydrogen refuelling unit which stores hydrogen in cylinders. Such unit can be delivered to site and used to refuel the vehicle in need via a nozzle, taking up only a few minutes. A JCB vehicle can be refuelled up to 16 times this way before refuelling unit needs to store up again.

Agriculture

Agriculture equipment in a way is somewhat similar to the construction industry. The fact that some of the machinery is on a smaller, more lightweight scale, means that progress made on BEVs for construction equipment can also be used when electrifying vehicles for agricultural needs. On the other hand, penetration of the BEVs in agriculture industry is still rather slow. According to Calstart‘s report (‘’Technology and Market Assessment of Zero-Emission Off-Road Equipment’’), only 57 electric tractors were sold in the USA during 2022, making up only a tiny fraction of 0.02% of all tractor sales. Hybrid tractors sold around 10 times more during this year, though that means they made up only 0.2% of the market share as well. However, by 2029, it is expected that sales of electric tractors will make up around 1% of the total US market share, with an additional 8% coming from hybrid configurations.

Mining

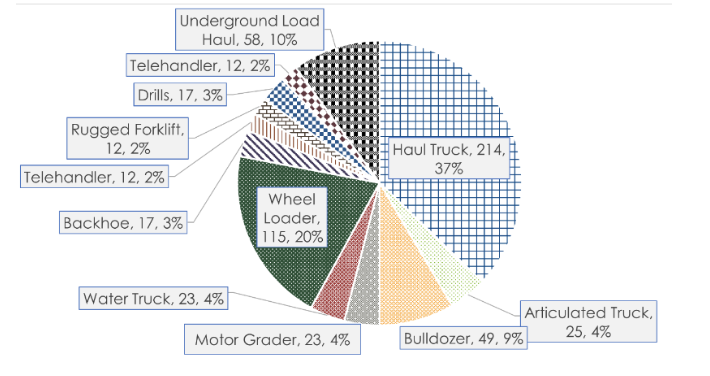

Bulldozers, motor graders, wheel loaders, forklifts, just a couple of vehicles that one is bound to see when visiting a specific mining location. But perhaps the most important machinery for this industry are the hauling trucks. As shown by Calstart in their report, in 2021 hauling trucks made up the largest part (37 %) of total mining equipment in California. The importance of electrification of these vehicles should not be understated, as they can contribute anywhere from 30 to 80 % emissions of the whole mining operation. However, this is where the challenge comes from. These vehicles are usually 2 -3 storey in height and weigh several hundred tonnes. Thus, power requirements and the design constraints that come with them are still a major challenge to overcome. Especially, as product reliability and longevity are also an important aspect for mining operations.

It is then perhaps not that big of a surprise that this area of OHVs is one that is seeing a lot of drastically different solutions coming from different manufacturers. For example, a Swedish mining company Boliden has installed trolley assist technology in Kevitsa copper nickel mine (Finland) and Aitik copper mine (Sweden). The latter was opened back in 2018 with only four mining trucks converted to use for a 700 meters trolley. However, the results were found to be so promising that a year later a decision was made to expand the trolley length up to 3 kilometres and convert an additional 10 mining trucks. It is expected that this will reduce the emissions coming from the mines by 15% over its life span. The mine in Finland, on the other hand, has a trolley length of 1.8 kilometres with 5 trucks already running on it and a conversion of another 10 planned for this year. While currently the system is a combination of diesel and electric propulsion, the president of Boliden Mines, Stefan Romedahl, mentioned that the long term strategy is to move towards a trolley system with pure BEVs.

On the other hand, we also have one of the most impressive hauling truck solutions by a partnership between Anglo American and First Gen. A truck that weighs 510 tonnes in total (with 220 tonnes being vehicle weight and an additional 290 tonnes for ore transportation) and is in a sense, a hybrid of hydrogen fuel cell technology and battery pack. Their combined power ends up being in the range of 2 MW. This powertrain choice combined the best of two worlds: energy recuperation capability by the battery during the regenerative braking phase, and the quick refuelling that is feasible with a hydrogen fuel cell. Interestingly enough, the truck is a retrofit of an older truck with a diesel engine, meaning the design space and configuration could not change from the original variant. A herculean effort, but it has now been a bit more than a year since this truck has begun its mining operations in South Africa. Going from here, the company is planning to retrofit an additional 40 mining trucks by 2024, and eventually the rest of their global fleet (~ 400 vehicles) in the near term future.

Purely electric hauling trucks can already been found in some mining locations as well. For example, a year ago, one of the largest heavy machinery manufacturers in China, XCMG Mining Machinery Co. Ltd has launched a carbon neutral hauling truck called XDR80TE. A 72 ton vehicle which is equipped with 525 kWh lithium ion batteries can run up to 36 cycles per day without stopping to charge, which is more than a day of operation. Two of these trucks have been given to a mining company Vale, which is testing them in the mines of Indonesia.

These are only a couple of examples of electrified hauling trucks, but we can see how companies are not afraid to look for different solutions when it comes to these vehicles.

Conclusions

To conclude, the electrification process of off highway vehicles is ramping up with equipment manufacturers making active steps to electrify their vehicles. The forecast growth of this segment is extremely important when moving towards a emission free future, as emissions of OHVs make up a significant portion of total global emissions. At the same time, it is clear there will not be a single uniform solution to rule them all. Battery electric vehicles, trolley lines, hydrogen fuel cells or combustion engines – depending on the equipment type and the demands for it, any of these solutions could end up being the best fit for a given manufacturer. The most important aspect of them all, though, is that they help us move towards a carbon neutral future.